SHENZHEN, China, Aug. 14, 2012 /PRNewswire-Asia/ — Impressive online shopping sales figures in China demonstrate that Chinese online fashion retailers such as Xiu.com have revived not only the European fashion industry but also the global fashion industry.

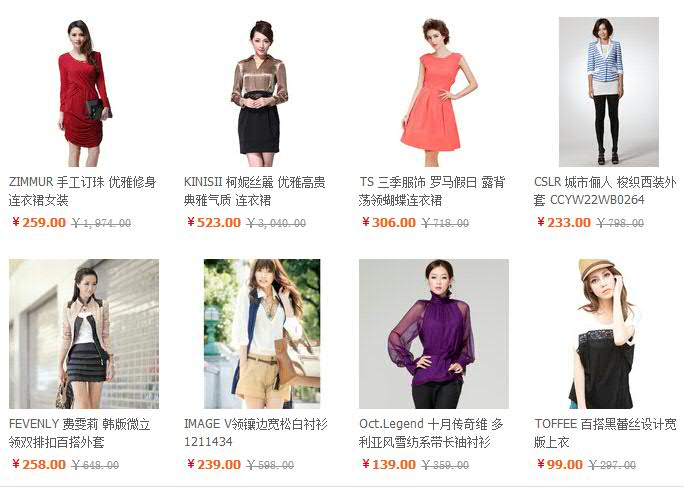

A screen shot of the lady’s clothing department of xiu.com.

Amazing sales figures

Xiu.com, a leading online fashion retailer in China, recently released its 2012 interim sales performance figures. Its sales revenue has tripled, with 80% of its sales brought in from imported brands. In contrast to Xiu.com’s rapid (geometric) growth, Net-a-porter, a pioneering premier luxury online fashion retailer, announced a deteriorating sales trend that began in April 2012.

Xiu.com is the only Chinese online fashion retailer listed in “The Digital 100” this year, according to a Business Insider report featuring the world’s most valuable startups in 2011. The website has successfully differentiated itself by franchising collections of many foreign labels that have limited local presence in the Chinese market such as BCBG, Babakul, etc. More and more brands are adopting a similar approach to tap into China’s market. In 2012, Xiu.com has acquired a number of franchises from a variety of global brands, namely IMAGE from Japan and The Children’s Place and American Apparel of the United States. Apart from playing the role of a direct dealer, the online retailer website works closely with other e-commerce platforms such as Karmaloop and JP Selects.

George Ji, CEO of Xiu.com, says that the website manages franchises for over one hundred new foreign brands. “Our sales performance has proven to the world that e-commerce is indeed an effective way to reach Chinese consumers with high purchasing power.”

High potential of the online shopping market in China

The European consumer market remains in the doldrums due to the ongoing financial crisis. The United Kingdom is no exception. According to the Office for National Statistics of the United Kingdom, sales volumes in April 2012 recorded the largest fall in year-on-year growth in the past two years, predominantly driven by clothing and footwear.

On the other side of the world, China has emerged as a huge and untapped market for fashion. The fashion market in China is expected to exceed 1.3 trillion RMB by 2010, according to a report by The Boston Consulting Group (BCG). However, benefiting from the growth is not guaranteed. Local players in the fashion industry are still in their infant stage of development despite the huge market demand. The cost of running a retail store in China has increased steeply. For example in Beijing, the rental cost in the city center is estimated to be on average 15 RMB per square meter a day, excluding other costs such as labour, fixtures and supplies, warehouse, logistics, government taxes etc.

More importantly, it is a challenge to effectively identify, locate and market to your target audience across 661 cities and 34 provinces. E-commerce emerged as a solution in response to this challenge. According to an official annual report of the China Internet Network Information Center (CNNIC), as of December 2011, the number of internet users is estimated to have reached 513 million, with 194 million people shopping online. While 37.8% of the internet users were considered online shoppers in 2011, this is a rapidly growing trend. The BCG report estimated that e-commerce business in the Chinese market will scale up to 32.9 billion USD by 2015, overtaking the United States as the largest online retail market.

Apart from the largest market of internet shoppers, Chinese consumers are considered the most active internet shoppers. A global study of multi-channel retailers by PwC showed that Chinese consumers conduct online shopping activities 4 times more frequently than Europeans and 2 times more than American and British consumers. 70% of Chinese say they shop online at least once a week.

With the presence of the world’s largest and most active e-commerce consumer group in China, what would be better than online marketing if you are new to the market? Despite the under-developed delivery infrastructure in the vast country, low costs and quick access to potential customers have made China the first choice for those looking to enter a new market.

An appropriate strategy for e-commerce

Given that Chinese consumers are already overwhelmed with regional and local online retailing platforms, online marketing does not necessarily imply success for your business. Choosing the right online retailing platforms with clear brand positioning and uniqueness is the winning secret to successfully tapping into the Chinese market.

Benefit Cosmetics of the LVMH recently closed its online store on Tmall.com, China’s largest B2C website. Similarly, Coach also stopped its collaborations with Tmall.com and plans to create its own online platform. IMAGE from Japan and The Children’s Place, a popular American brand for children’s apparel, went to Xiu.com.

Masakazu Myoga, CEO of IMAGE, was interviewed to share his perspectives on e-commerce strategy. Since a considerable amount of online retailers are accused of selling fake and cheap products in China, Xiu.com positioned itself as an upscale online department store, successfully differentiating itself from local competitors and matching the company’s need. Purchase orders of Xiu.com are reported to amount to 600-800 RMB on average, which is several times that of many local players in China.

In April 2012, IMAGE commenced promoting its products to the Chinese market through Xiu.com. A grand ceremony took place in Beijing to celebrate the partnership. IMAGE rapidly established its brand awareness among its target audience through Xiu Plus (Xiu.com’s official magazine), Xiu Ke Tong (a leading local fashion website) as well as direct mailing of EDM with the help of Xiu.com.

A PwC study on unique consumer behaviours amongst Chinese online shoppers found that unlike other countries, Chinese consumers are more willing to share their online shopping experiences. Comments from media and key opinion leaders play an important role in their decision making. According to Masakazu Myoga, Xiu.com was the ideal platform through which to better understand and reach out to consumers and build IMAGE’s brand image.

“Mankind and subjects are grouped by the same kind.”– a Chinese proverb.

Another interesting user habit among Chinese customers is the categorization of different consumer needs. Similar to filing in an office, Chinese customers tend to determine particular purposes for a particular online platform. For example, Taobao.com is stereotyped as the platform for low-end products, Dongdong.com specializes in books, 360buy.com is a portal for electronics and so on. If consumers want to purchase imported luxury and high-end fashion online, Xiu.com is the first choice.

This deep-rooted labeling culture provides hints for choosing the most appropriate e-marketing strategy. The search for a partner online platform should prioritize finding one whose brand positioning perfectly matches your own. Site traffic and number of users are secondary considerations. Chinese consumers are reluctant to believe that an online retailer can offer good-quality products if poor or fake products are available on the same platform. It is certainly ill-advised for new foreign brands to establish a negative stereotype among Chinese consumers.

“Xiu.com is committed to its position as an up-scale online department stone which fosters the growth of foreign brands in China’s market. With our assistance, they can benefit from the booming Chinese market and establish their brand presence,” said George Ji.

Future of Fashion

Apart from the forementioned brands, Havaianas, a famous Brazilian brand for flip-flops, has been put on the shelves of Xiu.com for its long waiting supporters in China; Henri J.Sillam, the renowned Austrian jewelry brand started its collaboration with Xiu.com earlier in April; and Babakul, an American designer brand has just started to celebrate its arrival through the online retailer in July.

Xiu.com is determined to be a leading online retailer for luxury and fashion. Up until now, only 60% of its products (perhaps less in the future) are available from other local online retailer platforms. The website has successfully differentiated itself from local competitors that are struggling in a price war. The premier online retailer is a good platform for new foreign fashion icons to establish their positive brand presence in China.

Since 2008, Xiu.com has rapidly established itself as the leading online fashion retailer in China by identifying high-end consumers and bringing international fashion brands to local consumers. Over 200,000 SKU products from 4000 brands are imported to China through the site.

George Ji shared his optimism for the development of the online fashion business in China. As a latecomer to the e-commerce business compared to other countries, Chinese online retailers indeed benefit from the rapid emergence and popularization of the internet and online shopping among Chinese consumers. Many online fashion retailers, led by Xiu.com, have already established an initial framework for their business and found a sustainable business model for the Chinese market.

“Online fashion retailers targeting upscale consumers are reliable business partners for brands,” George Ji commented. “The potential for online shopping has yet to be unleashed among Chinese internet users. It creates an optimistic scenario for the online retailing business.”

“Come to China and experience the future of the world’s fashion.”

SOURCE Xiu.com